A Juicyway Publication

4 Ways Nigerians Send Money in 2025 — and How Juicyway Makes It Simpler

From remittance apps to stablecoins, here’s how Nigerians really move money across borders in 2025 — what works, what doesn’t, and how Juicyway is making it finally seamless.

20 November 2025 - 6 mins readIf you’ve ever tried sending money home from abroad, or swapping currencies as a Nigerian living globally, you already know this truth: there’s no perfect system, just trade-offs.

Every platform fixes one problem and creates another.

So what do most of us do?

We juggle.

Between apps, vendors, wallets, and accounts — just to manage our own money.

In 2025, Nigerians move money in four main ways.

Let’s break down what’s really going on, where the leaks happen, and what’s quietly changing the game.

1. Mobile Remittance Apps: Fast, Familiar, and Often Costly

They’ve become the go-to. Apps like Remitly, Sendwave, LemFi, and Wise let you send money at 3 a.m., and your family in Lagos gets it before breakfast.

✅ Why people love them:

- They’re quick and reliable — your folks trust seeing “₦ credited.”

- They’re regulated, which means your money actually arrives.

- They support multiple corridors and banks.

⚠️ But here’s what they don’t say loudly:

- That “zero fee” often hides a ₦20–₦40 per USD markup.

- For larger transfers, small differences add up. Send $1,000 and you can lose ₦20,000+ quietly.

- It’s mostly one-way — sending to Nigeria, not back out.

Bottom line:

They’re solid for family remittances and emergencies — not ideal if you live a cross-border life where money flows both ways.

2. Traditional Money Transfer Services: Safe, but Stuck in Time

Your parents still swear by Western Union or MoneyGram.

You walk into an agent location, fill a form, and the money arrives — eventually.

✅ Why people still use them:

- Cash-pickup works for unbanked relatives.

- Familiarity and physical agent presence.

⚠️ Where it falls short:

- Fees can eat 6–10% of what you send (including exchange rate gaps).

- The UX feels like 2008, even with “new” apps.

- Transfers can take days.

- Forget flexibility — you can’t hold, convert, or reuse the funds digitally.

Bottom line:

They’re dependable for older recipients, but inefficient for anyone managing income or expenses across currencies.

3. P2P Vendors and Informal Networks: Great Rates, Real Risks

If you’ve ever said “I have an aboki plug” or joined a Telegram swap group, you know how this goes.

✅ Why it thrives:

- Better rates — ₦10–₦30 better per dollar than most apps.

- Works both ways — you can swap naira to USD or USDT anytime.

- Instant access, even on weekends.

⚠️ But the risk is baked in:

- Scams happen. Send to the wrong handle, and recovery is impossible.

- Banks sometimes freeze accounts over repeated P2P activity.

- Even regulated exchanges face occasional policy heat.

Bottom line:

P2P is the street-smart option; useful when you know your vendor and can take the risk. But it’s not sustainable for long-term or high-volume use.

4. Stablecoins (USDT, USDC): The Smart Hedge With Real-World Limits

For many Nigerians, stablecoins aren’t about crypto hype, they’re survival tools.

✅ Why people use them:

- Inflation hedge. Save ₦1M in naira, it shrinks. Save it in USDT, it holds value.

- Easy global transfers. Send money in minutes without traditional rails.

- Freelancers, traders, and small businesses use them daily.

⚠️ But here’s the fine print:

- You can’t spend USDT directly at Ebeano or book a flight — you’ll still need to convert.

- Off-ramping safely (getting back to naira or fiat) is still clunky and can incur fees.

- Regulation keeps shifting — compliance is now mandatory.

Bottom line:

Stablecoins protect value and simplify global transfers — but they’re still disconnected from everyday spending.

The Real Story: We’re All Using Everything

Most Nigerians living globally run some version of this setup:

- A Remittance app for family.

- Traditional transfer when someone insists on cash pickup.

- P2P when you need better rates.

- A Stablecoin wallet for savings and client payments.

The result?

You’re managing four systems that don’t talk to each other — and a constant mental tax of rate checks, log-ins, and cross-conversions.

That’s the real leak: not just in fees, but in focus.

The Shift Happening in 2025

This is where things are evolving.

The future isn’t about choosing one channel.

It’s about connecting them all so your money moves as easily as you do.

We built Juicyway for this exact life, where you earn in USD, spend in NGN, save in USDT, and maybe pay rent in CAD.

Here’s how it works:

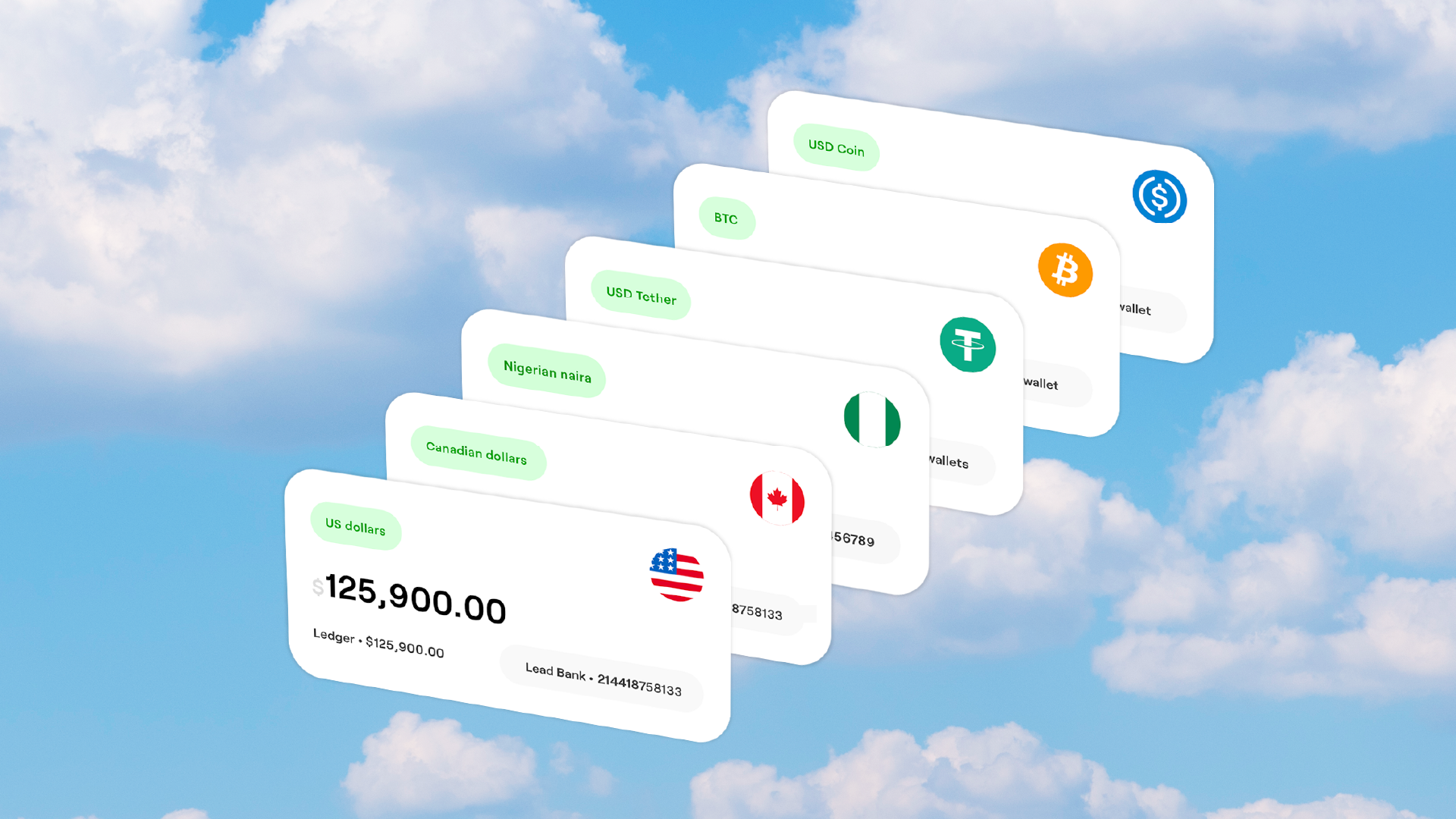

- One multi-currency wallet: Hold NGN, USD, GBP, CAD, EUR, USDT, USDC, BTC, and ETH — all in one place.

- Instant conversions: Swap between currencies in seconds at transparent market rates. (Limit orders execute automatically when your set rate hits.)

- Fast transfers: Local transfers → instant. International transfers → relatively fast:

- CAD via Interac: lands within minutes.

- USD Payments land typically in 24+hours

- Stablecoin & crypto transfers: instant.

- Cross-border simplicity: Send to family, vendors, or clients without juggling apps.

- Regulated and secure: Built through licensed financial partners with full KYC and encryption compliance.

We’re not promising to erase all borders, we’re promising to make them feel lighter.

Why This Matters

Nigerians today live globally by default.

We earn, invest, and support family across continents, and we need financial tools that keep up.

Juicyway exists for that life.

We’re saying: you deserve fewer hoops, better rates, and control that matches how you actually live.

If you’ve ever opened four apps just to move one payment, you’ll feel the difference immediately.

Juicyway — Built for the life you already live.

Multi-currency wallets. Real-time swaps. Zero middlemen.

Because money should move as freely as you do. 💜

[Download Juicyway] — Start simplifying how you send, hold, and spend.

FAQs

- Is Juicyway licensed? Yes. Juicyway operates through licensed financial partners in supported corridors and adheres to AML/KYC and data-security standards.

- Can I hold crypto and fiat in one place? Yes. You can hold USDT, USDC, BTC, ETH, and major fiat currencies like NGN, USD, GBP, CAD, and EUR — with seamless conversion between them.

- Are transfers instant? Local transfers are instant. International transfers typically complete within hours, depending on the receiving country’s payment rails.

- Any hidden fees? No. You see the rate before confirming — what you see is what you send.

- Can I use Juicyway abroad? Absolutely. Whether you’re in Nigeria, Canada, the U.S., or the U.K., you can send, receive, and convert currencies seamlessly through one account.