A Juicyway Publication

The Hidden Cost of Helping Home — How Africans Abroad Can Support Family Without Going Broke

For many Africans abroad, sending money home is love wrapped in pressure. Here’s how to support family sustainably, protect your future, and send smarter with Juicyway

17 November 2025 - 7 mins readWe want to tell you about Chioma.

She’s a Nigerian nurse living in Boston, earning about $4,500 a month - good money by most standards.

Last month, she found herself staring at her banking app at midnight, wondering how her account balance had dropped faster than she could say “emergency.”

That week alone:

- Her mum needed $800 for hospital tests.

- Her brother’s school fees were due - $400.

- A cousin in the U.K. texted: “Things are tight. Can you send something small?”

By the 15th, she’d sent nearly half her income home.

Her own rent was due in five days.

She whispered to herself:

“I’m tired of choosing between helping family and eating proper meals.”

And the truth is, Chioma isn’t unusual.

This is the quiet reality for millions of Africans living abroad: the unspoken rule that follows you everywhere —

If you can, you must.

The Weight Nobody Talks About

Across Africa and the diaspora, sending money home isn’t just generosity.

It’s expectation. It’s duty.

School fees. Medical bills. House repairs. “Just something small.”

And most of us send it — because saying no feels like betrayal. You remember when things were harder.

But what happens when “family first” starts to mean “you last”?

What happens when you’re building everyone’s future except your own?

Black Tax: The Obligation With No End Date

There’s a name for it: Black Tax.

It’s the financial responsibility placed on high-earning Africans — especially those abroad — to support extended family, often at the expense of their own stability.

It’s not malicious. It’s cultural.

For many, it’s the only safety net their families have ever known.

But there’s a hard truth we rarely admit:

Helping your family is beautiful. But doing it without structure quietly breaks you.

The Real Cost (Beyond the Money)

1. You spend emotionally, not strategically

Most remittances go out under the word “urgent.”

But not every emergency is an emergency.

You send money fast because asking questions feels cold.

Yet emotional giving, without limits, means your own goals never move.

2. You Lose Value Before It Even Reaches Home

Let’s say you’re sending $500 from the U.S. to Lagos.

You check the rate on Monday: ₦1,620/$

By Thursday, your app auto-converts at ₦1,580/$

That ₦40 gap just cost you ₦20,000 — without warning.

Most platforms don’t let you set the rate.

They convert when it suits them, not when it favors you.

3. There's no budget, so there's no end

Without limits, every request feels valid: ₦50k here, ₦30k there, ₦10k “something small.”

Before you know it, you’ve sent ₦400k this month and saved ₦0 this year.

4. Your future keeps getting delayed

No emergency fund. No investments. No home savings.

Every time you’re ready to start, another call comes in. And because you care, you send again.

But burnout — financial or emotional — helps no one.

The Guilt of Setting Boundaries

You’re probably thinking:

“But they’re my family. How can I say no?”

Because for us, boundaries feel like betrayal.

We remember who paid our school fees.

We know how hard things are back home.

We don’t want to be “that relative” who made it and forgot.

But boundaries aren’t selfish, they’re how you keep giving without collapsing.

Even love needs structure.

5 Quiet Rules to Support Family Without Destroying Yourself

These aren’t about cutting people off.

Its about building a system that protects everyone — including you.

Rule 1: Set emotional boundaries before financial ones

The hardest part of giving isn’t the money. It’s the guilt.

You can still help, just with clarity.

Try:

- “I can support this amount monthly.”

- “I’ll need to check my budget first.”

- “I can’t this time — but next month, yes.”

The people you love need you stable too. 💜

Rule 2: Turn "emergency money" into a family fund

One wallet, One monthly amount, and that's it.

Pick an amount you can give monthly, say ₦150k.

Keep it in a separate account or Wallet. When requests come in, pull from that wallet.

When it’s empty, you pause until next month.

You don’t have to disappear to be dependable, you just need a system.

Bonus: You can still give surprise extras when you want to, but not out of pressure.

Rule 3: Help family earn, not just depend

Sometimes the most generous thing is a one-time gift that ends the cycle. 🎓 Pay for a course. 🛠 Buy a tool or equipment. 🚀 Co-fund a small business.

Support that multiplies >>> support that drains.

Rule 4: Detach love from money

"Funds of affirmation" is one love language: not the only one.

Sometimes, love looks like:

- Phone calls

- Advice and guidance

- Being present

- Celebrating wins

You can show up without always showing your wallet.

Rule 5: Stop losing money to terrible exchange rates

A ₦30 swing per dollar can erase your good intentions.

Before sending:

- Check the current rate

- Compare platforms

- If the rate is terrible, wait (if you can)

Better yet, use tools like Juicyway, where you can set limit orders — meaning you decide when and at what rate your money converts.

Hold Money in Stable Currencies

If you earn in USD, GBP, or EUR, don’t rush to convert everything to naira.

Inflation is a silent thief. ₦500k today may not be ₦500k next month.

Instead:

- Keep part of your income in stable currencies (USD, USDT).

- Convert only when needed.

- Track your value, not just your transfers.

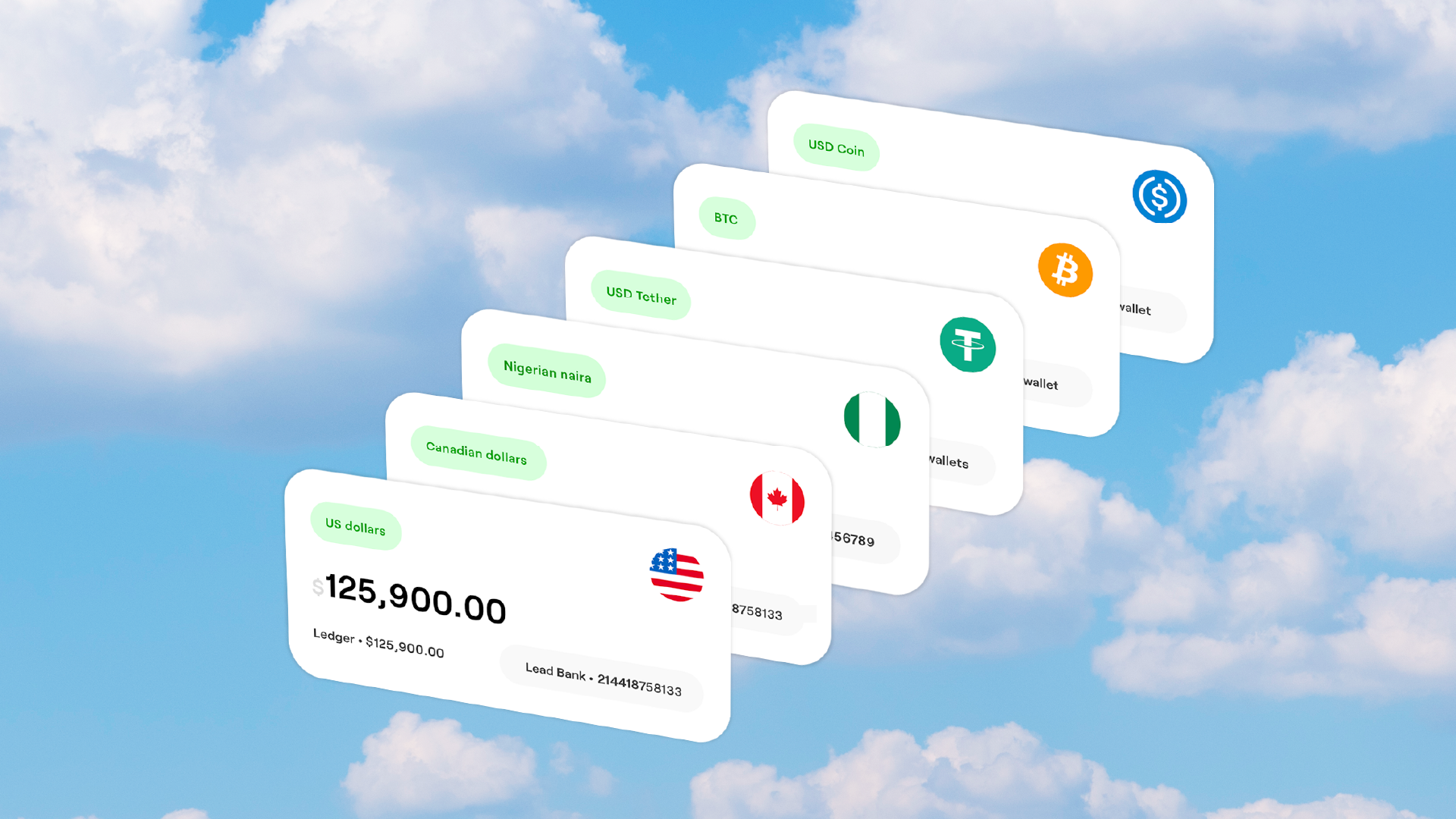

With Juicyway, you can hold NGN, USD, CAD, EUR, USDT, and USDC, all in one account.

That means your value stays protected, even when the market doesn’t.

The Conversation Nobody Wants to Have

At some point, you’ll have to say it out loud:

“I want to help, but I also need to build my own stability. Here’s what I can do consistently.”

It may sting at first.

Some will understand, some won’t.

But long-term, your steadiness will help more than your panic transfers ever did.

💜 What Juicyway Does for People Like Chioma

Supporting family across borders is already hard. The tools you use shouldn't make it harder.

Juicyway was built for Africans living and earning between currencies — people who send love and money.

Here’s how it helps:

Hold money in multiple currencies (NGN, USD, CAD, EUR, USDT, USDC) → Keep different currencies for different purposes. Use USD for business, NGN for family, USDT for savings — all in one account.

Set limit orders or use market orders → You decide when and how your money moves, not the platform.

Send money instantly across borders → Zero delays. No more "3-5 business days." Your family gets it when they need it.

Convert only when it makes sense → Bad rate today? Hold it. Good rate tomorrow? Convert. You're in control.

It's not about sending less. It's about sending smarter, so you can keep helping without losing yourself in the process.

The Balance You Deserve

You are not selfish for wanting stability.

You are not a bad child for saying, “I can’t right now.”

You are not betraying your culture by building your future.

Your family needs you stable — not stretched thin.

Because you can’t pour from an empty wallet.

Support home, protect yourself, and make your generosity sustainable.

With structure. With clarity. With tools made for how you live.

Juicyway — Send Smarter. Live Freer. 💜

Hold, send, convert, and protect your value — all in one place.

Ready to send smarter? Download Juicyway now and take control of your money.