A Juicyway Publication

All Our Multi-Currency Wallets Explained: How to Get the Most from Managing USD, EUR, NGN, and More on Juicyway

We explain how Juicyway’s multi-currency wallets make sending, receiving, and managing money across borders simple, secure, and stress-free.

22 September 2025 - 3 mins readFor many Africans, the idea of a multi-currency wallet feels unnecessary — until a trip abroad comes up, or a relative needs to send money from overseas. The usual thought is: “If I’m not travelling, why do I need it?” or “My friends only send pounds, so my GBP account is enough.”

But here’s the truth: a multi-currency account is more than just a travel tool. It’s about financial freedom, flexibility, and smarter money management. And with Juicyway, it’s easier and more rewarding than ever.

What Is a Multi-Currency Wallet?

A multi-currency account lets you hold, send, and receive different currencies in one secure place. Instead of juggling multiple bank accounts across countries, you manage everything from one app.

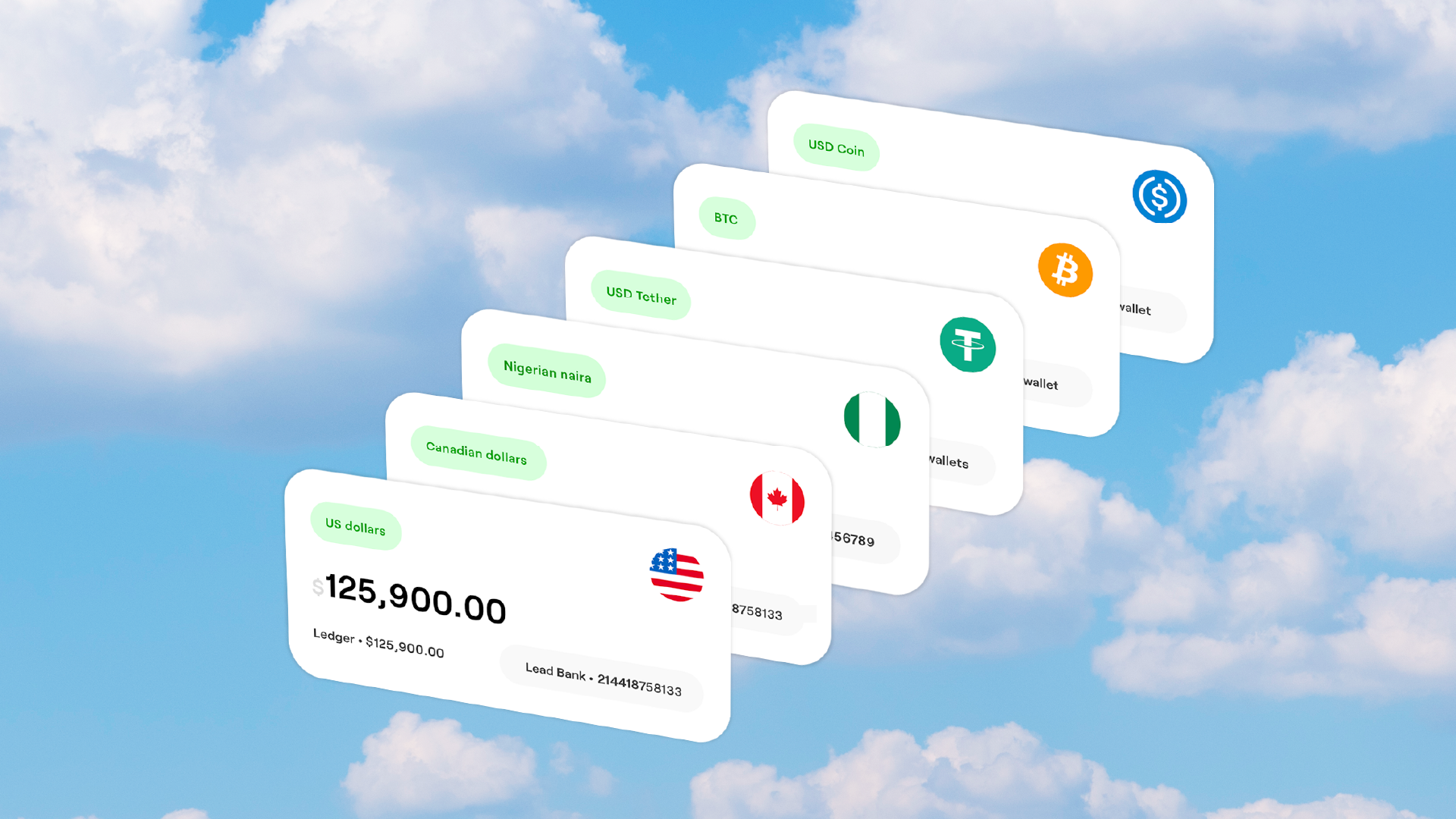

On Juicyway, you get:

- 5 major currency wallets (NGN, USD, CAD, GBP, EUR).

- 8 digital asset wallets, including 2 stablecoins (USDT, USDC) and 6 popular cryptocurrencies (ETH, DOGE, ADA, BTC, TRX, SOL).

This powerful mix makes cross-border payments, international money transfers, and even digital asset transactions seamless and efficient.

Why Juicyway’s Multi-Currency Wallets Hit Differently?

- Direct transfers without conversion - Send GBP, USD, or crypto directly without forced conversions or complicated steps. Whether you’re trying to transfer money internationally or send locally, the process is simply smooth.

- Free deposits across all currencies - Top up your accounts without worrying about extra fees. Juicyway makes it easy to hold your funds in USD without paying deposit charges, perfect for anyone tracking the dollar to naira rate.

- Zero maintenance fees - Yes, wallets need maintenance, but never at your expense. They remain secure and free to use.

- Instant access - Every user automatically gets an NGN wallet at signup. Unlocking the others only takes a quick KYC process.

Managing Money Made Simple

Juicyway puts all your money tools in one place:

- Deposit – Add funds to your wallet.

- Transfer – Send money locally or use it as your go-to money transfer service abroad.

- Convert – Swap between currencies easily.

- Request – Generate payment links to receive money from others.

One app, four major money functions, there is absolutely no need for multiple money transfer apps.

For Your Everyday Use Cases

Juicyway’s multi-currency wallets are built for real life:

- Protect your money from volatile dollar-to-naira swings.

- Send money from Canada to Nigeria or across borders without stress.

- Shop and subscribe globally from streaming platforms to online stores.

- Receive payments for freelance work, remote jobs, or even into your business account.

Whether you’re an individual or managing a business account, Juicyway ensures your money moves easily across borders.

So What Is The Juicyway Difference?

Multi-currency accounts aren’t just for frequent travellers or people with family abroad. They’re for anyone who values flexibility, security, and convenience in handling money.

This is what we do at Juicyway, we brings it all together in one app — making international money transfers and everyday payments simple, affordable, and drama-free.

Now that’s the Juicyway difference. 💜